Option data for February series remains well distributed across strikes for Calls of 11,000 to 11,500 and for Puts from 11,000 to 10,600 with open interest ranging from 20-25 lakh shares each indicating option players remains cautious ahead of Budget with bets placed at both sides.

January series ended with a big jump as benchmark Indices scaled to all-time highs. The Nifty gained 5.6 percent while Bank Nifty gained 7.6 percent viz-a-viz last monthly expiry.

Rollover for Nifty stood at 65% compared to 71% last expiry while for Bank Nifty rolls were at average 71 percent. January series marked Nifty PCR OI moving to highest point in last 5 years at 1.89.

Better than expected Q3 earnings by corporates followed by FII inflows of Rs 9,500 crore in the cash market and Pre-budget expectation propelled the momentum significantly.

Option data for February series remains well distributed across strikes for Calls of 11,000 to 11,500 and for Puts from 11,000 to 10,600 with open interest ranging from 20-25 lakh shares each indicating option players remains cautious ahead of Budget with bets placed at both sides.

Notable Open Interest of 48 lakh shares is standing at 10500 PE indicating vital support area. Significant change in OI distribution could pave way for directional momentum.

Further decoding Participant activity in Index futures reveals FII have carried forward 1,44,197 contracts of Index longs ( highest in last two months) while Index Short carried over were mere 36,578 lowest in last 1 year indicating their positive stance on the market.

In Index Options too FII added significantly to their positive bias with Synthetic long /Short ratio {(Call Long +Put Short)/ (Put Long+ Call Short)} placed at 1.29, highest in last 6 months.

Synthetic Long /Short ratio are placed at 0.95 signifying nearly equal position on both sides. Possibility of Volatility based strategies placed before Budget event.

India VIX, an indicator to riskiness did give a breakout from the range of 12-14% towards 18.5 percent to settle the series at 17.51 percent, with gain of 25 percent.

Historically, it’s being witnessed that with events lined up, various time frame traders gets active and take position in option market to participate in wild swings leading to surge in Implied Volatility of options. Post the event, possibility of mean reversion increases.

Strike-wise PCR OI for Feb series remains in neutral zone. Immediate support is placed at 10,900 at 1.52 followed by 10,700 at 2.09 signifying temporary indecisiveness about the trend.

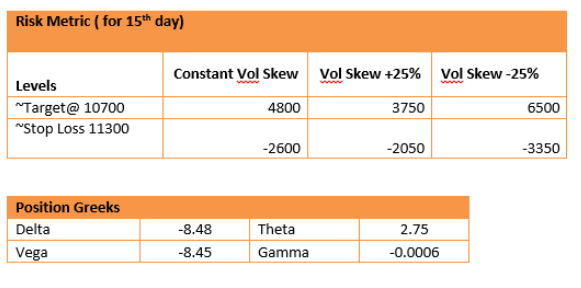

Considering possible pause in momentum due to surge in volatility & shift in PCR band on lower side a hedge strategy “Modified Put Butterfly Spread” is recommended to protect from downward movement or to take a speculative bet on downside.

Modified Put Butterfly Spread is a Neutral to Bearish Strategy that’s executed by buying 1 Put, Selling 2 lower side Puts and Buying 1 further lower Put.

Change in volatility doesn’t impact strategy to larger extent as it is hedged. Time decay is generally harmful when index is at first strike however it’s beneficial when it’s at middle strike.

MORE WILL UPDATE SOON!!

0 comments:

Post a Comment