Stocks picks of the day: 11,400-11,450 likely to act as key resistance for Nifty

Any decisive break below 11,300 could add further selling pressure in Nifty.

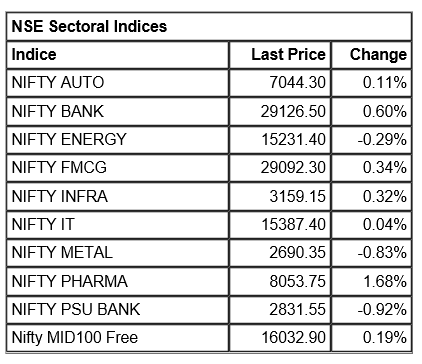

After a volatile trade session on July 23rd, Nifty indices ended the day in the negative zone for the fourth consecutive session and closed well below the 11,350 mark, dragged by banking, auto and pharma counters.

On the derivative front, 11,400 levels would be a crucial level from expiry point of view as call writers are still holding the open interest of nearly 35 lakh shares in 11,400 strikes.

However, any decisive break below 11,300 could add further selling pressure in Nifty. On the technical front, the 200-days exponential moving average is likely to act as crucial support for the index.

The overall breadth of the market is slightly bearish as of now and we expect that any technical bounce should be used to create fresh short positions.

On the technical front, on the upside, 11,400-11,450 would be key resistance for Nifty with the current trend moving towards 11,200-11,150 levels.

Here is a list of top three stocks which could give 7-13 percent return in the next three to four weeks:

Power Grid Corporation of India: Buy| Target: Rs 224| Stop Loss: Rs 199| Upside 7 percent

After witnessing a breakout above Rs 200, the stock has been consolidating in the range of Rs 200-210 from the last four weeks.

On the daily as well as weekly charts, the prices are trading well above its short and long term moving averages along with steady buying at lower levels.

This week we have observed a fresh breakout into the prices above Rs 210 levels after prolonged consolidation which could trigger follow-up buying in the stock.Traders can accumulate the stock in the range of Rs 208-211 for the upside target of Rs 224 levels, and a stop loss below Rs 199.

Garden Reach Shipbuilders & Engineers: Buy| Target: Rs 147| Stop Loss: Rs 120| Upside 13 percent

The stock has been trading consistently with the formation of higher top and higher bottom on the daily interval. However, from the last two months, some consolidation has been witnessed into the price in the broader range of Rs 115-120.The stock gave a fresh breakout this week above the consolidation zone along with larger volumes which are a positive sign. Traders can accumulate the stock in the range of Rs 130-132 for the upside target of Rs 147 levels, and a stop loss below Rs 120.

Thermax: Buy| Target: Rs 1222| Stop Loss: Rs 1,020| Upside 11 percent

After taking support at its 200-days exponential moving average (EMA) on the daily interval, the stock took a 'U' shape recovery and once again surpassed above Rs 1,100 levels.On the broader chart, the stock has also given a break above the ‘Cup & Handle’ pattern which is bullish in nature.

The momentum oscillators at the current juncture are pointing towards a short term consolidation. Traders can accumulate the stock in a range of Rs 1,100-1,105 levels for the upside target of Rs 1,222 levels, and a stop loss above Rs 1,020.

MORE WILL UPDATE SOON!!