It was a good start to the year 2018 as benchmark and midcap indices ended the week at fresh record closing high despite higher crude oil prices, driven by positive global cues and progress on PSU bank recapitalisation. Also, hopes of government meeting its FY18 fiscal deficit target of 3.2 percent of GDP boosted sentiment.

The 50-share NSE Nifty settled the weekly session at 10,558.85, up 0.3 percent and the 30-share BSE Sensex rose 0.3 percent to 34,153.85 while the broader markets outshone frontline indices, with the Nifty Midcap rising 1.7 percent.

The market has been trading at premium valuations due to consistent liquidity support and hopes of earnings recovery going ahead.

The positive momentum amid volatility is expected to continue in the coming week as well, but the move is likely to be largely dependent on corporate earnings season that will be kickstarted by TCS, Infosys and IndusInd Bank.

Expectations from Union Budget 2018, which will be presented in the Parliament on February 1, may also keep market volatile. Hence, both these events may point towards more stock specific action in the coming week, according to experts.

"The Budget will create volatility and lots of noise but fundamental solid policy change matters a lot to the direction of the economy and inflation and is therefore important for the markets," Madhav Dhar, Managing Partner of GTI Capital Group, said in an interview to CNBC-TV18.

Vinod Nair, Head Of Research at Geojit Financial Services, said the market was wary of a populist Budget since this is last one before general elections. In the immediate future, market will look for more Budget related cues and as per progress of Q3 results season, he added.

In recent times, higher oil prices, rising inflation and RBI's hawkish stance have been ominous for the market, Nair said.

Here are 10 key factors that keep investors busy next week:-

Earnings

The December quarter earnings season will see the Q3results of blue-chip companies like Infosys, TCS and IndusInd Bank in the coming week.

Generally, corporate numbers are an important indicator of economic growth. After steady earnings recovery in Q2FY18, most analysts expect the second half of FY18 (Q3 and Q4) to give clear directions for FY19 earnings.

The earnings recovery momentum is likely to accelerate in Q3FY18. We estimate PAT of our 230 coverage companies to grow 14 percent YoY (first half of FY18: 2 percent). Unlike previous quarters, earnings growth is likely to be more broad-based.

Key things to track include: a) hit on banks’ treasury income (owing to higher interest rates); b) impact of higher commodity prices on gross margins of consumer companies; c) GST related issues; and d) FX impact on export-oriented sectors such as, IT and pharma, it added.

Infosys

The country's second largest software services provider will announce its first quarterly earnings under newly appointed CEO & MD Salil Parekh on January 12.

Ovearll IT earnings for Q3FY18 are expected to be impacted by furloughs and holiday season but as major global currencies were fairly stable during Q3FY18, currencies are not expected to materially affect revenue growth or margins, Edelweiss said.

Brokerage houses expect Infosys to report revenue growth at around 1-1.5 percent. Impact of weakness in revenue growth for the company would be offset by operational efficiencies.

Kotak expects Infosys to maintain guidance of 5.5-6.5 percent constant currency revenue growth and 23-25 percent EBIT margin.

For all IT companies’ earnings, Edelweiss said it would keenly monitor: 1) Infosys’ strategic roadmap post appointment of new CEO, Salil Parekh; 2) demand commentary in BFSI & retail 3) clients’ budget & pricing in legacy business; 4) traction in digital services; and 5) pace of local hiring in US.

TCS

Tata Consultancy Services, the country's largest IT services provider, will declare its earnings on January 11. Analysts largely expect company's revenue growth at around 1 percent for the quarter.

Revenue growth to be impacted due to sustained softness in BFSI and Retail, while rest business will continue good momentum. EBITDA margins expected to contract by 30bps QoQ on account of seasonal furloughs.

Commentary on client budgets, spends by BFSI and retail clients are key monitorables, it added.

IndusInd Bank

IndusInd will be the first to announce third quarter earnings among largecap banks on January 11. It is likely to give some directions to earnings of other banks.

Largely it is expected to be soft quarter for banks due to softer revenue momentum and elevated credit costs, Edelweiss said, adding earnings of retail-heavy private banks are expected to be stable while corporate-heavy banks are likely to incur elevated credit costs (ageing provisions, provisions on accounts referred to NCLT by RBI).

In case of IndusInd, Kotak expects limited asset-quality stress but divergence, if any, could be reported this quarter. Progress on Bharat Financial acquisition is likely to be discussed, it feels.

The research house expects loan growth at 24 percent YoY, led by steady growth in retail business. NIM will remain stable QoQ supported by higher share of retail loans, it feels.

Macro Data

The data for November industrial production and December CPI inflation will be released after market hours on Friday.

The retail inflation measured by the Consumer Price Index for November had increased to a 13-month high of 4.88 percent, from 3.58 percent in October, mainly due to increase in food and oil prices, while India’s industrial output slowed to 2.2 percent in October as compared with 3.8 percent a month ago.

Foreign exchange reserves data for the week ended January 5 will also be announced on Friday while balance of trade data will be declare on Wednesday.

Crude

Brent crude futures, the benchmark for international oil prices, crossed USD 68 a barrel level for the first time since May 2015 is the key risk for country like India which imports more than 80 percent of oil requirement.

Brent crude futures settled the week below that level, at USD 67.62 a barrel. Experts expect the crude can hit USD 70 a barrel, which is still manageable for India but beyond that the risk will increase in terms of widening fiscal deficit. Not only economy but also companies that are depend upon on crude.

"Presently, Indian economy is under stable state and can manage till crude prices are below USD 70-72, will alarm concern if it sustains above USD 75 for longer time," Yogesh Mehta, VP- Retail Research, MOSL said in an interview to Moneycontrol.

Technical Outlook

After decisive close above 10,550 for the first time may drive the Nifty above 10,600 level but beyond that it needs strong cues (could be in earnings or Budget). After record high levels, some consolidation can't be ruled out, experts suggest. According to them, 10,400 will remain immediate support for the Nifty.

The short term trend of Nifty is positive amidst range bound action. The upper range 10,550-60 levels is placed at the verge of upside breakout, but the upside momentum is not picking up at the highs.

The formation of back to back lacklustre type candle pattern as per weekly timeframe is not suggesting healthy uptrend at the new highs. Though, there is no confirmation of any reversal pattern at the highs, but the danger of beginning of downward correction from the highs is not ruled out.

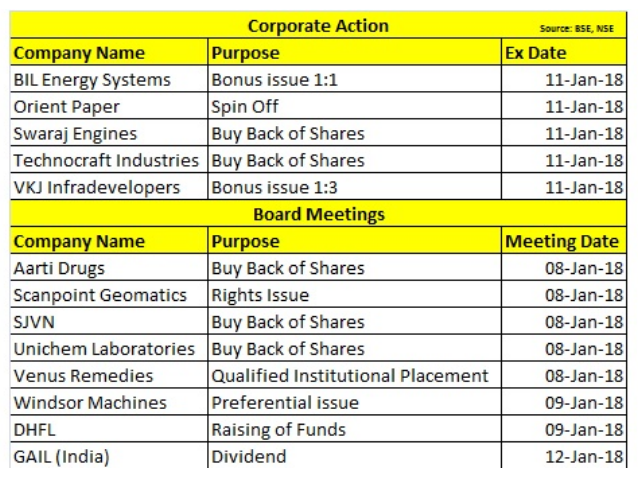

Corporate Action

Stocks in Focus

On Monday, Goa Carbon is expected to react positively to its Q3 earnings. It has posted net profit at Rs 22.50 crore against net loss of Rs 0.93 crore in year-ago and revenue more than doubled to Rs 186.6 crore from Rs 82 crore YoY.

Tata Steel's India production and sales in Q3FY18 were at 3.24 million tonnes and 3.30 million tonnes (provisional data), higher compared with 3.03 million tonnes and 3.08 million tonnes in Q2FY18, respectively. Europe steel production increased to 2.68 million tonnes (provisional) from 2.60 million tonnes but sales declined to 2.41 million tonnes from 2.60 million tonnes YoY.

Uttam Galva Steels reported loss at Rs 179.96 crore for October-December quarter 2017 against loss of Rs 257.28 crore in year-ago and revenue declined sharply to Rs 666.90 crore from Rs 1,035.61 crore YoY.

Sobha during December quarter achieved new sales volume of 9.33 lakh square feet (valued at Rs 750.9 crore) with an average realisation of Rs 8,045 per square feet, which is the highest every quarterly sales performance in terms of value and average realisation. Sales volume increased 8.4 percent and sales value 11.2 percent QoQ; and 52 percent & 92 percent YoY.

Lanco Infratech's shareholding in subsidiary Lanco Kondapalli Power reduced to 28.15 percent from 58.91 percent and hence, lenders' controlling stake stood at 52.21 percent after strategic debt restructuring.

NBCC shares may also react positively as the company has received contract from Ecotourism Development Corporation of Uttarakhand, Dehradun for construction of Kotdwar-Ramnagar Kandi Road amounting Rs 2,000 crore.

NACL Industries said the board of directors approved to raise funds to the tune of Rs 300 crore for meeting its growth plans.

Den Networks has entered into an agreement with cable TV distribution company VBS Digital Distribution Network (VBS) for acquiring 51 percent stake in VBS for Rs 2.64 crore.

Visa Steel is in discussion with SBI for settlement after the SBI filed an application with National Company Law Tribunal Kolkata to initiate corporate insolvency resolution process for the company under Insolvency & Bankruptcy Code.

Global Cues

Europe's industrial sentiment for December and retail sales for November will be announced on Monday, followed by unemployment rate for November on Tuesday.

China's December CPI and US' gasoline production will be released on Wednesday while Europe's industrial production for November and US' initial jobless claims will be announced on Thursday. European Central Bank will also publish account of monetary policy meeting on Thursday.

US' CPI and retail sales data for December will be declared on Friday.

MORE WILL UPDATE SOON!!