Portfolio check: These top stocks could return 21-115% in 1 year

After hitting record highs in late January, followed by sharp sell-off, the market has been consolidating and trying very hard to move towards that all-time high.

The Sensex rallied 4 percent in the first half of 2018, but the broader market corrected sharply with the Nifty Midcap index falling 14 percent, especially after the strong 48 percent outperformance in 2017.

Experts said some mid, small and largecaps are trading at attractive valuations. We expect stock-specific movement in largecaps to continue to support the market. But mid and smallcaps are likely to take more time to settle.

Considering the current rangebound trade, they feel the market may be waiting for earnings to pick up from the second half of FY19.

Big reform decisions taken by the government, normal monsoon resulting in a likely increase in consumption and an earnings recovery continue to support the market, but global trade concerns, volatility in crude oil prices, weakening rupee versus the dollar and an increase in the cost of capital are headwinds to the rally.

In the backdrop of higher fuel prices, increase in interest rates and a weakening rupee-dollar scenario, we are of the view that market may trade in a range and is unlikely to witness any strong appreciation in the next 6-8 months.

Invest in quality stocks, which are less vulnerable to macro concerns and have healthy cash flow visibility. Considering the likely pick-up in rural consumption, higher utilisation and recent reforms, he is hopeful that corporate earnings will witness double-digit growth in coming quarters.

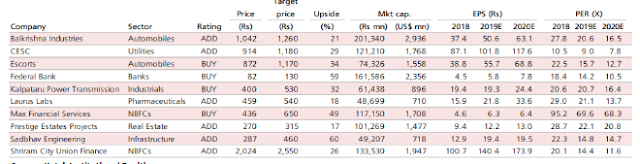

Here is the list of top stocks that could return 21-115 percent in a one-year period:

Larsen & Toubro: Buy | Target - Rs 1,540 | Return - 23%

L&T enjoys several levers across its business/geographical segments. It has emerged as the E&C partner of choice in India, which provides a robust foundation to capitalise on the next leg of investment cycle.

Under its new five-year strategic plan to FY21, L&T aims to: (a) grow sales at 12-15 percent CAGR to reach Rs 2 lakh crore by 2021, (b) expand margins to 11.2 percent, up 120bp over FY16, driven by higher profitability in key manufacturing verticals (power, process, forgings and Katupalli yard) and hydrocarbons, (c) unlock value via asset sales to drive RoE to 18 percent from 12 percent in FY16 and (d) reduce working capital to 18 percent of sales from 20 percent currently.

Manufacturing businesses (like Shipyard, Power BTG, and Forgings) also offer interesting possibilities over the longer term. Many of these businesses are difficult to replicate, and L&T is strongly positioned as a dominant player.

We maintain Buy with an SOTP-based target price of Rs 1,540 (E&C business at 22x FY20E EPS, to which we add Rs 520 for subsidiaries). The stock trades at 19x/15x its standalone business (ex. subsidiaries) on FY19/FY20 EPS versus its historical average of 22x. Key risks to the rating include (a) a sharp slowdown in government spending and (b) a sharp fall in oil prices in the Middle East.

Tata Steel: Buy | Target - Rs 700 | Return - 25%

Tata Steel and ThyssenKrupp AG have signed a definitive agreement to combine their European steel businesses in a 50:50 joint venture to be named ThyssenKrupp Tata Steel BV headquartered at Amsterdam, Netherlands.

The formation of the joint venture paves the way to offload significant debt from Tata Steel's consolidated balance sheet to the new joint venture. The deleveraging of balance sheet would aid the management to focus more on the profitable domestic business and pursue organic and inorganic growth prospects.

We continue to remain positive on the domestic steel consumption story driven by increased government expenditure/policies and supportive macros. We like Tata Steel given the integrated nature of domestic operations, which enables it to report higher EBITDA/tonne vis-à-vis its domestic peers.

Going forward, for Indian operations, we maintain our sales volume estimate of 12.5 MT for FY19E and 12.8 MT for FY20E with EBITDA/tonne estimate of Rs 13,250 per tonne for FY19E and Rs 14,000/tonne for FY20E.

For European operations, we model sales volume estimate of 10 MT and EBITDA/tonne estimate of $75/tonne for both FY19E and FY20E, respectively. We value the stock on an SOTP basis and maintain target price of Rs 700. We maintain Buy recommendation on the stock.

Tata Chemicals: Buy | Target - Rs 876 | Return - 27%

Tata Chemicals' specialty chemical (S&C) businesses includes salt, agri inputs, pulses, spices and nutritional solutions. Tata Chemicals has adopted a strategy for the next 3-5 years to focus on its S&C business and consumer business. Post exiting from fertilizer business, Tata Chemicals is planning to increase the contribution from S&C business to around 35 percent by FY20E, considering the current product portfolio.

It is exploring new avenue in FMCG sector, which is a high margin business with low working capital.

Tata Chemicals has reduced its debt through sale of investment in Tata Global Beverage, divestment of the fertilizer business and also through cash generated from its operations. Currently, it has a net cash position of Rs 1,02 crore while net consolidated debt is around around Rs 4,130 crore.

With global leader in soda ash and sodium bicarbonate, exiting from low margin fertiliser business, focus on specialty chemical and consumer business, exploring new avenue in FMCG sector with Tata Sampann and reduction of debt through sale of investment, we value Tata Chemicals at 7.00x FY20E EPS of Rs 125.20 to arrive at target price of Rs 876.

Exide Industries: Buy | Target - Rs 320 | Return - 25%

As the company is one of the largest leaders in the battery space, it is likely to get benefit, if the demand scenario improves. Moreover, it is also expected that cost reduction initiative and focus on profitable segment would drive the margins going forward.

Thus it is expected that the stock will see a price target of Rs 320 in 8 to 10 months time frame on a current P/E of 31.56x and FY19 (E) earnings of Rs 10.14.

Persistent Systems: Buy | Target - Rs 971 | Return - 21%

According to the management, the company expects an accelerated demand from enterprises to leverage digital ecosystems for innovation and growth. Its emerging technologies, transformational experience and continued progress with collaborations and acquisitions would give optimism for its growth going forward.

Moreover, a gradual improvement in utilization rate and better revenue growth in the non-linear business would support EBITDA margin. Thus, it is expected that the stock will see a price target of Rs 971 in 8 to 10 months time frame on an expected P/E of 21x and FY19 (E) earnings of Rs 46.23.

Mahindra & Mahindra Financial Services: Buy | Target - Rs 609 | Return - 34%

Mahindra & Mahindra Financial Services (MMFS) is one of India’s non-banking finance companies focused in the rural and semi-urban sector and is one of the largest Indian tractor financier.

The company is primarily in the business of financing purchase of new and pre-owned auto and utility vehicles, tractors, cars, commercial vehicles, construction equipment and SME Financing.

The company’s strength in vehicle financing which is showing good traction across products & geography. Its housing-finance loan growth is expected to expand 18-20 percent CAGR.

The main driver for improvement in RoA would be gradual increased share of SME business going ahead. Normal Monsoon, Higher farm income and Govt. spending will give boost to company’s business.

The company has a strong Rural & Semi-Urban area presence – with 1284 offices covering 27 States & 4 Union Territories. The company has a healthy mix of Both - ( A) Vertical lending across products & (B) Geographic mix which reduces volatility & risk. We have a Buy coverage on M&M Financial with a target price of Rs 609 per share.

Indostar Capital Finance: Buy | Target - Rs 650 | Return - 29%

Indostar Capital Finance (Indostar) is an NBFC promoted by Mauritius-based Indostar Capital (a holding company with a 57.7 percent stake in Indostar and owned by various institutions, including the Everstone Group, which has a 51.2 percent stake in Indostar Capital).

It commenced operations in 2011. In Apr’17, Sridhar (ex-CEO of Shriram Transport) was appointed Indostar's CEO to lead its foray into vehicle and housing finance. The company has demonstrated strong execution capabilities (loan book posted a 25 percent CAGR over FY14-18) by initially building the corporate book (74 percent of loans as of FY18) and subsequently entering SME financing and effectively executing its strategy in the segment (23 percent of loans as of FY18).

Over the past year, the company has tried to balance its loan book by diversifying its exposure into retail segments such as vehicle and housing finance.We forecast a net profit CAGR of 25 percent over FY18-20E, led by strong loan growth (50 percent CAGR over FY18-20E) and steady asset quality.

We forecasts RoA/RoE of 3.1/11.2 percent by FY20E (versus 3.7/11.7 percent in FY17). Indostar trades at 1.3x BV FY20E, which is the cheapest among NBFCs in coverage. We initiate coverage with a Buy rating and a Mar'19 target price of Rs 650, valuing the stock at 1.7x Mar’20 PB (implied FY20 P/E of 16x).

J Kumar Infraprojects: Buy | Target - Rs 321 | Return - 42%

Buttressed by stable order inflows so far this fiscal, JKIL is eying projects over Rs 4,500 crore for the next couple of years, including metro rail orders of Pune, Mumbai Delhi and Bangalore. It recently bagged order for construction of underground shafts and R&R facilities for Pune Metro Rail worth some Rs 222 crore.

Yet large orders of the size of Mumbai Metro Line 3 have not been assayed last fiscal. It missed out on not so thinly discussed projects like Mumbai Trans Harbor Link (MTHL) and Mumbai Nagpur Expressway (where it failed to emerge among 18 successful bidders). It also lost out on Mumbai Metro Line 4 corridor order where consortiums of Reliance Infrastructure and Tata Project emerged as successful bidders.

Earnings fortification over the next few years rest on timely execution of sizeable projects - Mumbai metro line2, line 3, and JNPT road projects.

Execution of newly bagged projects like Pune Metro Rail, improvement of Chheda Nagar Junction, Ghatkopar and construction of South Delhi Municipal Corporation Head Quarter would not gather pace before the start of next fiscal.

On balance, we advise buying the stock with revised target of Rs 321 (previous target: Rs 273) based on 13x FY20e earnings (forward peg: 0.7) over a period of 9-12 months.

Capacit'e Infraprojects: Buy | Target - Rs 397 | Return - 48%

Notwithstanding the recent turmoil in EPC stocks, business fundamentals of Capacit’e Infraprojects continue to strengthen—not only has the company entered the public sector space that widens its catchment area, it continues to bag repeat orders from multiple clients in the private sector.

With its book-to-bill crossing 5x, the company is set for robust growth (Building a reputation for quality; initiating coverage). We believe investors looking for quality companies with a proven track record, strong earnings potential (31 percent EPS CAGR over FY18–20), a lean balance sheet (negative net debt) and attractive valuations (13.3x FY20E EPS) should consider Capacit’e.

We expect steady topline growth, a stable margin trajectory and declining debt to drive 23 percent revenue CAGR and 31 percent EPS CAGR over FY18–20E (excluding BDD Chawls).

Additionally, rising scale and better cash flow will lend impetus to return ratios. We maintain Buy with a target price of Rs 397 assigning P/E of 20x to FY20E earnings.

MORE WILL UPDATE SOON!!