After buoyant equity markets seen in the year 2017, Indian markets witnessed a selloff, a much awaited one post Budget where stocks from the S&P BSE 500 index corrected up to 50 percent in just one week.

Stocks which have suffered a double-digit cut include names like Vakrangee (down 58%), PC Jeweller (down 30%), Fortis Healthcare (down 27%), Just Dial (down 27%), Reliance Naval (down 27%), and IFCI (down 25%) among others.

The S&P BSE Sensex has fallen nearly 2000 points in the same period while the Nifty50 lost nearly 600 points in the same period.

The fall was largely led by both domestic and global factors. On the domestic front, the rise in crude oil prices, fiscal slippage, the rise in interest rates and long-term capital gains tax (LTCG) weighed on sentiment.

Considering that inflation is likely to rise further from hereon as suggested by the monetary policy committee statement, it is unlikely that interest rates will go down.

On the contrary, we are in the era of rising interest rates scenario & the same thing is happening globally. If this trend continues and globally interest rates firm up, it makes India less attractive market in the near-term to attract fresh flows.

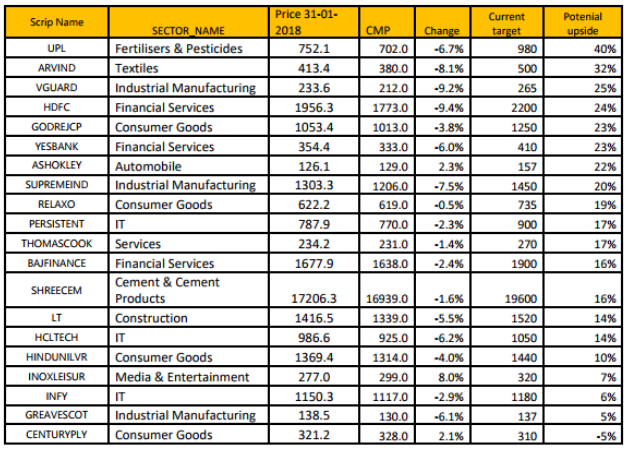

We feel that markets may see some more consolidation at the current levels. However, some stocks & sectors can give more returns from the current level as compared to broad markets.

Globally, rising bond yields and fear of US Fed raising interest faster than expected led to some churn in Wall Street which led to a fall of near 1600-point drop in Dow earlier in the week.

The setup looks ripe for investors who want to be in Indian equity markets for the long term. Investors should buy those stocks where the growth visibility is high as against the ones which have fallen more, suggest experts.

A massive fall in a stock does not account for it being a value play. Instead, investors should hunt for those stocks which stand to benefit from the reforms tabled by the finance minister in the Budget 2018.

Laregcap stocks are a better play at current levels while investors should remain cautious while putting fresh money in the midcap stocks at current levels.

Based on risk-reward ratio, Nifty looks better off than the Midcap Index as the upside potential of both is similar i.e. 15-16 percent. “The risk-reward ratio of Mid Cap Index could look attractive with another 5-6% correction from current levels. Based on valuations the potential downside in Nifty works to 5% and that of the Mid Cap Index works to 12%.

Though there are individual stocks in the midcap space that have already corrected and can be accumulated at current levels and also declines..

Corrections are part of every bull market and as long as Nifty is holding above its key support levels, the upside remains intact. Investors should use dips to buy into quality stocks on every dip.

History suggests that in a bulls market, 10 percent type of correction is alright. A meaningful dip also helps investors to jump in who were waiting on the sidelines. But, making money will not be easy in 2018 unlike the year 2017.

My sense is that our markets would remain volatile till there is stability in the Global Markets and VIX settles down. It is difficult to gauge the extent of correction but a 10% fall in the index is considered normal in a bull marke.

Investors should stick to quality stocks rather than eyeing the high beta names. One thing which investors should avoid is to stop their running systematic investment plans (SIPs) and instead focus on accumulating stocks from those sectors which are likely to benefit most from Budget.

Ups and downs are part of the market and these are necessary for keeping the market healthy and buoyant. While stocks have seen good corrections in the market fall, it seems to be warranted given the sizable rally in the past 12 month.

Emerging markets are likely to perform better than developed markets, and among emerging economies, India stands out due to the various reforms especially the forward-looking GST implementation this government has done.

Few sectors we are positive on are, Specialty Chemicals, Infrastructure, Auto ancillary, discretionary consumption, textile and real estate ancillary companies.

SHOPPING LIST:

APL Apollo tubes, Century textiles, Dalmia Bharat, L&T and Maruti Suzuki.

It will depend on the individual stock credentials. However, we feel that stocks which have fallen less or have not fallen at all (eg. Ashok Leyland) are more resilient & were not driven by speculative money.

Companies with good businesses & good management generally do well in the long term and are also able to weather big corrections. Largecap stocks with least correction are expected to outperform markets in medium to long term. One needs to look at future earnings potential for the stock selection.

MORE WILL UPDATE SOON!!