Market Update/S&P 500 Analysis/DOW 30 Analysis /Nasdaq 100 Analysis

S&P 500

The S&P 500 shot higher during the day on Tuesday, as traders in America trying to start the so-called “Santa Claus rally” that tends to happen every year. Ultimately, the 2600 level above is the major barrier that we are trying to break above, and it does look like we may be able to. However, we are bit overextended and it’s possible we may pull back. It is because of this that I am awaiting a daily close above the 2600 level to serve buying, and I also recognize that with Thanksgiving being on Thursday, it’s likely that the markets shrivel up after 24 hours. Ultimately, I think that the market will continue to be very noisy, with a proclivity to buy the dips going forward as algorithmic traders have done so for so long. If we do break above the 2600 level, the most logical place to look for resistance would be the 2650 handle, and I think that we will eventually find pullbacks to give us an opportunity to pick up value.

On the breakout, the 2600 level should offer a floor in the market, as what was once resistance should become support. That’s essentially how I’m looking at this market, and although we could pull back from here and go drifting lower, I have no interest in shorting this market as it is obvious that longer-term pressure is still to the upside. The general attitude of the market is every time we fall there is value, and towards the end of the year is very likely that we will have plenty of fund managers out there that need to prove themselves fully invested as the returns have been rather phenomenal the last several months. In general, I think upward is where we go.

S&P 500 has broken the floor of the rising trend, which indicates a weaker initial rising rate. The index has broken up through the resistance at points 2594. This predicts a further rise. In case of negative reactions, there will now be support at points 2594. RSI diverges negatively against the price, which indicates a danger for a reaction down. The index is overall assessed as technically positive for the short term.S&P 500 shows a strong development within a rising trend channel. A further positive development is indicated, and there is support against the floor of the trend channel. The index has support at points 2400. RSI diverges negatively against the price, which indicates a danger for a reaction down. The index is overall assessed as technically positive for the medium long term.S&P 500 is within a rising trend. Continued positive development within the trend channel is indicated. Has risen strongly since the positive signal from a rectangle formation at the break through the resistance at 2084. The objective at 2362 is now met, but the formation still gives a signal in the same direction. The index has support at points 2390. The index is overall assessed as technically positive for the long term.

Dow Jones 30

The Dow Jones 30 exploded to the upside during the trading session on Tuesday, slicing through the 20,500 level. The market then broke above the 23,600 level, and I think that we are getting a bit overextended as we try to break out to the upside. Pullbacks to the 23,500 level are possible, but I think that should be plenty of buyers in that area and therefore it’s likely that we continue to see the Dow Jones 30 rally over the longer term. US stocks have been very strong for some time, and I think that it’s unlikely to change anytime soon, although we could get a bit of a pullback from time to time I have no interest in shorting, and given enough time I think that we will reach towards the 24,000 handle.

NASDAQ 100

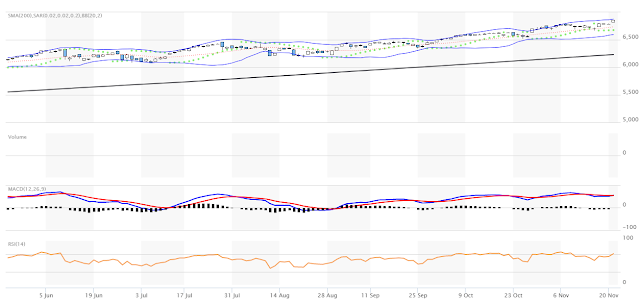

The NASDAQ 100 has broken to the upside, reaching a fresh, new high. Ultimately, the market looks as if it is a bit overextended as I record this, but quite frankly I think that the pullback will be bought. I’m looking at the 6340 level for buying opportunities, and I believe that we will eventually go to the 6400 level. If we were to break down below the 6300 level, it would be very negative, but in the meantime, I think that the buyers are more likely than not to take over the market and push towards higher levels. Longer-term, I anticipate a significant move and attempt to reach the 6500 level above. Volatility will continue, but in general I believe that the buyers will have the upper hand, as the NASDAQ 100 tends to lead the rest the American stock markets higher. As we head towards the end of the year, the “Santa Claus rally” seems to be winding up. I believe that short-term pullbacks will continue to offer value the traders are more than willing to take advantage of, and that the 6250 level should be now the “floor” of the uptrend, but quite frankly I would not be surprised at all to see the 6300-level offer just as much support. I think that we are eventually going to break out to the upside in drag the rest of the US indices with us, as the NASDAQ 100 tends to lead the way overall. I have no interest in shorting this market, so waiting for pullbacks to show signs of support or an extension of the uptrend to put money back to work. Longer-term, I anticipate seeing the market go towards 6500.

Market Update

Strong Stock Futures Point Wall Street to New Records, Oil Prices

on the Rise.

In what is expected to be

a thinly traded pre-Thanksgiving session, stock futures pointed to a slightly

higher open for Wall Street on Wednesday, Nov. 22, as stocks aimed to continue

record-setting gains from a day earlier.

Dow Jones Industrial

Average futures gained 40 points, or 0.17%, S&P 500 futures increased about

3 points, or 0.1%, and Nasdaq futures rose about 9 points, or 0.14%. All three

major indexes notched record intraday and closing prices on Tuesday, Nov. 21,

as strength in healthcare and tech bolstered investor optimism. Stocks have

traded higher in three of the last four sessions.

Global oil prices flirted

with two-year highs on Wednesday as an expected dip in domestic production

combined with ongoing disruptions to imports from Canada lifted markets ahead

of next week's OPEC summit in Vienna.

West Texas Intermediate

crude futures for December delivery popped higher by 1.79% to $57.85 a barrel

in trading early Wednesday, leaving prices just shy of their two-year high of a

little more than $58. International benchmark Brent crude futures traded at

$63.23, up 1.05%.

Durable goods orders in

October declined 1.2% vs. an expected 0.3% increase. Ex-transportation, durable

goods orders in the U.S. increased 0.4%, just shy of analysts' expectation of a

0.5% increase. In the previous month, durable goods orders increased 2%.

Weekly jobless claims

declined 13,000 to 239,000. Wall Street had expected 240,000 claims. The

decline in jobless claims came after two consecutive weeks of increases,

suggesting steady job growth.

The economic

calendar in the U.S. on Wednesday also includes Oil Inventories for the

week ended Nov. 17 at 10:30 a.m., and minutes from the Nov. 1 meeting of the

Federal Open Market Committee at 2 p.m. The Fed's minutes are widely expected

to show that the bank is poised to raise interest rates at its Dec. 12-Dec. 13

meeting.

Family dinner Thursday

evening might bring some drama, but don't look for the same in equities markets

ahead of Thanksgiving. Traders will manage a somewhat boring day Wednesday

ahead of the holiday. Markets will be closed Thursday, Nov. 23, and will open

for a half-day of trading until 1 p.m. EST on Friday, Nov. 24.

Deere &

Co. shares jumped 4.6% in premarket Wednesday, indicating shares will open

at a record high as the company reported profit and sales that topped

expectations for its fiscal fourth quarter. Deere reported earnings of

$1.57 a share, 10 cents higher than FactSet analysts expected. Revenue

increased 23% to $8.02 billion, topping Wall Street's forecast of $7.92

billion. The company said it expects its fiscal first-quarter equipment sales

will surge 38% from a year ago as South American demand grows.

Market moving fundamental events

Asian stock markets mostly moved higher after

new highs on Wall Street ahead of the U.S. Thanksgiving holidays. What other

market drivers do traders need to pay attention to?

22 November,– Optimism over global growth continues to

propel indices higher although the CSI 300 retreated slightly after yesterday’s

gains, as yields spiked in China while coming down in Japan, Australia, New

Zealand.

UK 100 and U.S. stock futures are also

higher, as are oil prices, with the front end WTI future trading at USD 57.68

per barrel.

European Market Outlook:

The European data calendar is pretty empty,

with only preliminary Eurozone consumer confidence in the afternoon. Events

include a German 10-year Bund auction and the U.K. budget, while in Germany

Merkel’s search for a way out of the stalemate continues.

US Market Outlook:

U.S. equities are back at record highs after their opening lunge

higher, propped up by a solid run higher in China on hopes regulators there

will managed their shadow banking problems (Hang Seng rallied 1.9%) and hopes

that Germany’s Merkel will extricate herself to form a coalition government

without calling for new elections (German GER30+0.8%). That spilled over to a

pre-Thanksgiving binge on Wall Street, paced by a 1% rally on NASDAQ and

followed by 0.6-0.7% gains on the blue-chip indices.

Speaking of tech, Apple +2%, 3M +1.5% and

Microsoft +1.3% are the Dow’s leaders on the upside, while Wal-Mart -0.7% is

the deepest decliner. The VIX equity volatility index is 6.7% lower and back

under 10.0, well off the 14.51 November high set amid tax cut plan divergence

between the House and Senate.

That fear now appears to be on the

back-burner, though some heavy lifting remains to reconcile the two tax bill

versions and sell the unified plan to the public before year-end. Meanwhile,

the USD index remains around 94.0, while gold rebounded back over $1,283 and

WTI crude has consolidated 1.5% higher near $57.92 bbl.

Main Macro 22 November Market moving

fundamental events:

·

UK

Autumn Forecast Statement – Released

yearly.

·

US

Durable Goods – Expectations

– rise 0.3% vs 2.0% in September due to the hurricane rebound, or 0.4%

ex-transportation.

·

US

Jobless Claims & UoM Sentiment- Expectations – revised their decline by 15k to

234k for the week ended November 18, while final Michigan sentiment may be

nudged to 98.0 in November from a preliminary 97.8, down from 100.7 in October.

·

Oil

Inventories – Expectations – decrease

by 1.4 mln barrels.

·

FOMC

Meeting Minutes

MORE WILL UPDATE SOON!!