-

Investment in equity market can be risky.Find the right investment ideas to achieve your financial goals.

Investment in equity market can be risky.Find the right investment ideas to achieve your financial goals. -

Understand yourself and your risk apetite.We will help you finding the right stock for you.Yes we will tell where and when to buy.

-

Know how all markets are linked together and what helps them move up and down both fundamentally and technically.

Know how all markets are linked together and what helps them move up and down both fundamentally and technically. -

Will help make viewers make right investment decisions by giving then quality research based stock investment picks and ideas.

Will help make viewers make right investment decisions by giving then quality research based stock investment picks and ideas. -

This blog will help investors and viewers mint money and provide timly trading tips in all Cash ,Future and Option segment.

This blog will help investors and viewers mint money and provide timly trading tips in all Cash ,Future and Option segment.

Friday, 23 August 2019

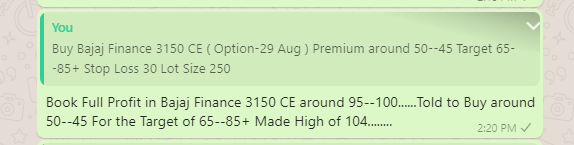

Our Bajaj Finance 3150 CE call Skyrocketed........Profit of Rs on 10000 on 1 Lot

Today We had given a call to Buy Bajaj Finance 3150 CE ( Fut-29 Aug ) premium around 50--45 for the target of 65--85

Look at the call as Today it made a High 104 and now closed around 82

Patience wins the trade.......

We Booked Part Profit Today around 85 even in such volatile market

Profit of Rs 10000 on 1 Lot.......

We Believe in our Research......

Hope You Minted Profit.

This call was given free in Our whatsapp group.

Still Looking for trade or confused!!..............Don't Worry Join Our Team......

KEEP TRADING FOR FREE>Just Click on link below

or

E-Mail Us at indianmarketpulse@gmail.com

or

Call:8303052186

Our LIC 420 CE call Proved Fruitful in Volatile market.....Profit of Rs 5500 on 1 Lot

Today We had given a call to Buy LIC Housing Finance CE ( Fut-29 Aug ) premium around 9--10 for the target of 14--16

Look at the call as Today it made a High 14.05 and now closed around 11.25.

Patience wins the trade.......

We Booked Part Profit Today around 14 even in such volatile market

Profit of Rs 5500 on 1 Lot.......

We Believe in our Research......

Hope You Minted Profit.

This call was given free in Our whatsapp group.

Still Looking for trade or confused!!..............Don't Worry Join Our Team......

KEEP TRADING FOR FREE>Just Click on link below

or

E-Mail Us at indianmarketpulse@gmail.com

or

Call:8303052186

MORE WILL UPDATE SOON!!

Our Nifty 10800 PE Hits its target.........Profit of Rs 2952 on 1 Lot

Today We had given a call to Sell Nifty 10750 PE ( Fut-29 Aug ) premium around 110 for the target of 70--50

Look at the call as Today it made a low of 62 and now closed around 73.

Patience wins the trade.......

We Booked Full Profit Today around 71 even in such volatile market

Profit of Rs 2925 on 1 Lot.......

We Believe in our Research......

Hope You Minted Profit.

This call was given free in Our whatsapp group.

Still Looking for trade or confused!!..............Don't Worry Join Our Team......

KEEP TRADING FOR FREE>Just Click on link below

or

E-Mail Us at indianmarketpulse@gmail.com

or

Call:8303052186

MORE WILL UPDATE SOON!!

Our Nifty 10750 CE Hits all its target.........Profit of Rs 5625 on 1 Lot

Today We had given a call to Buy Nifty 10750 CE ( Fut-29 Aug ) premium around 100--90 for the target of 145--160

Look at the call as Today it made a High of 171.20 and now closed around 157.

Patience wins the trade.......

We Booked Full Profit Today around 165 even in such volatile market

Profit of Rs 5625 on 1 Lot.......

We Believe in our Research......

Hope You Minted Profit.

This call was given free in Our whatsapp group.

Still Looking for trade or confused!!..............Don't Worry Join Our Team......

KEEP TRADING FOR FREE>Just Click on link below

or

E-Mail Us at indianmarketpulse@gmail.com

or

Call:8303052186

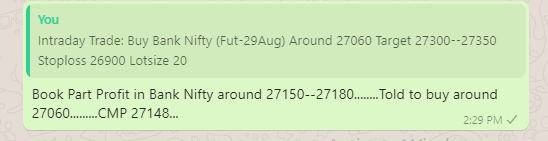

Our Bank Nifty Call Proved fruitful in Volatile Market......Profit of Rs 2400 on 1 Lot

Today We

had given a call to Buy Bank Nifty ( Fut-29 Aug ) around 27060 for the

target of 27300--27350

Look at the

call as Today it made a High of 27250 and now closed around 27040.

Patience

wins the trade.......

We Booked

Full Profit Today around 27150--27180 even in such volatile market

Profit of

Rs 2400 on 1 Lot.......

We Believe in our Research......

Hope You

Minted Profit.

This call

was given free in Our whatsapp group.

Still

Looking for trade or confused!!..............Don't Worry Join Our Team......

KEEP

TRADING FOR FREE>Just Click on link below

or

E-Mail

Us at indianmarketpulse@gmail.com

or

Call:8303052186

MORE WILL UPDATE SOON!!

Rupee at 8-month low; here are 10 stocks that could benefit from the fall in INR

A feeble rupee is not a good sign for the market as it indicates that foreign investors are bearish on the market and exiting their positions.

Trading at its lowest level since December 2018, the Indian rupee opened lower by 10 paise at Rs 71.91 per dollar on August 23 versus the previous close of Rs 71.81.

The domestic currency looks set for the biggest monthly fall in six years as it is down 4.6 percent this month and 3.1 percent in 2019.

Chinese yuan's fall has also put pressure on emerging market currencies. As per Reuters, the yuan slumped to an 11-year low. Traditionally, Indian currency follows its Chinese counterpart as both countries aim to remain export competitive.

A feeble rupee is not a good sign for the market as it indicates that foreign investors are bearish and exiting their positions. At a time when the market has a lot to worry in terms of the trade war, weakening the economy and lacklustre corporate earnings, the fall in rupee can only aggravate the outflow of foreign funds.

However, there are select sectors and stocks that can help you reap profit despite rupee’s weakness, pharma and IT figure prominently among them.

Here are 10 stocks that are likely to gain from rupee's fall:

Infosys: The stock remains one of the preferred bet because of the company’s consistent performance, strong management, positive sector outlook and stable long term growth prospects.

The company has near term challenges, but long-term growth outlook remains bright on the back of rupee's weakness, positive management guidance, large orders and higher payout to shareholders.

Tata Consultancy Services: India’s largest IT company offers its services to a wide range of industries such as BFSI, manufacturing, telecom, retail, transportation and insurance.

It has over 4.2 lakh consultants present in over 50 countries. In terms of revenue, 51 percent of its business comes from North America.

We believe the company is well placed to benefit from the increasing demand for offshore IT services seen over the last decade. Further, the company’s wide experience and strong clientele would enable it to maintain its strong position in the IT space.

Wipro: Wipro will be one of the beneficiaries of a falling rupee as it means higher dollar earnings for IT firms. The exact impact of rupee depreciation depends upon each company’s hedging policy as well as the proportion of offshoring business. Besides this, other fundamentals aspects are also important for investing in a company.

The analyst believes near-term challenges persist for the company as there is a weakness in a few verticals such as the capital markets segment in BFSI and manufacturing segment in Europe. However, the digital business has been performing well.

The company is likely to maintain a strong cash balance of over Rs 20,000 crore (post buyback) and boasts of strong free cash flow. It also trades at a discount to its peers indicating upside potential in the long-term.

Divi's Labs: The company has no foreign exchange debt and has not hedged future revenues.

Its 70 percent of the revenue is in foreign exchange. Rupee's fall will add to sales and margins as Divi's is a net exporter.

Sun Pharma: The company got a benefit of Rs 67.4 crore due to its foreign transactions as against a loss of Rs 90 crore in the previous year.

The company has a foreign exchange debt of Rs 6,422 crore and net foreign exchange exposure is 60-65 percent of revenue.

At operating level, the company’s EBITDA grew at 24.2 percent to Rs 1,996 crore while its margin expanded 166bps YoY that was aided by favourable gains in foreign currency (200bps). Falling rupee will add to sales and margins as it is a net exporter.

Mphasis: The company has expertise in application development and maintenance, infrastructure outsourcing, and business and knowledge process outsourcing.

The company has won new deals in direct international business with TCV of $151 million in Q1FY20; 80 percent of deal wins is in the focus area of new-gen services.

Going ahead, improvement in margins, momentum in deal wins, decent revenue growth coupled with rupee depreciation are the catalysts to drive strong earnings growth.

Biocon: Biocon is one the largest and fully-integrated, innovation-led biopharmaceutical company emerging globally with presence in over 120 countries.

We continue to expect the company to get benefits of the first wave of biosimilar commercialisation in the next two years, which should drive higher revenues and margins, adding that the rupee's weakness will be a further catalyst for it.

Balkrishna Industries: A competent off-highway tyre manufacturer, Balkrishna has a strong fundamental profile and is a global player with around 6 percent market share in the off-highway tyre industry.

Fine Organics: Fine Organics is likely to benefit from rupee’s decline as it generates around 60 percent of its revenues from exports.

Indo Count Industries: Indo Count Industries looks attractive as it exports to 54 countries across the globe and stands to benefit the most during currency fluctuations.

MORE WILL UPDATE SOON!!

Stock picks of the day: Next immediate support for Nifty50 is placed at around 10,750

The next immediate support for Nifty50 is placed at around 10,750 and then towards 10,600 levels, while resistance is observed at 11,110 and then towards 11,200 levels.

The benchmark index, Nifty50 breached its previous four-day consolidation pattern on the downside on August 21 to close below 11,000 levels. On the daily time frame, the index witnessed a breakdown from the bearish flag pole pattern which can further sink prices towards its next immediate support which is placed at 10,600 levels.

Previous three days’ candle formation suggests that the immediate pullback got capped at 11,200 levels, and the index has now opened gate for further downside.

The NSE-NIFTY reversed before visiting its short-term moving average placed at the 20-day EMA the daily interval.

On the Options front, maximum Put open interest is placed at 10,850 followed by 10,500 strikes while the maximum Call open interest is seen at 11,000 followed by 11,500 strikes.

The next immediate support for Nifty50 is placed at around 10,750 and then towards 10,600 levels, while resistance is observed at 11,110 and then towards 11,200 levels.

Here is a list of top three stocks which could give 6-7 percent return in the next three-four weeks:

NIIT Tech: Buy| LTP: Rs 1,365.45 | Target: Rs 1,460|Stop Loss: Rs 1,310|Upside 7 percent

After a prolonged consolidation, the recent price action has pushed the prices above its horizontal trendline resistance. This week, the stock gave a fresh breakout above the key resistance levels of Rs 1,350 along with marginally higher volumes which suggest that upside is likely to continue in the coming sessions.

Continuous outperformance against the benchmark index can be witnessed in prices in the near future as well. Prices are sailing above all its major exponential moving averages.

The overall IT index has outperformed the benchmark index since the past couple of months. Traders can accumulate the stock in the range of Rs 1,360 – 1,370 for the target of Rs 1,460, and a stop loss below Rs 1,310.

Nestle India: Buy| LTP: Rs.12,594.10| Target: Rs 13,350|Stop Loss: Rs 12,210| Upside 6 percent

Nestle India is trading in higher-high higher-low formation the on weekly interval chart. The recent price action has given a breakout above the Ascending triangle pattern on the weekly chart, which will act as a continuation of the current trend.

A price pattern breakout supported with an above-average volume on the weekly interval is a positive sign. The momentum oscillator RSI (14) is hovering between a 60 – 70 ranges which hint for a continuation of ongoing momentum.

Traders can accumulate the stock in the range of Rs 12,570 – 12,620 for the target of Rs 13,340, and a stop loss below Rs 12,210.

IndusInd Bank: Sell| LTP: Rs. 1,367.20 | Target: Rs 1,285|Stop Loss: Rs 1,415|Downside 6 percent

On the weekly chart, IndusInd Bank has broken down from trendline support placed at Rs 1,450. Further, it has turned south after facing resistance at the 61.8 percent Fibonacci retracement level which suggests weakness.

Prices are trading below all its major exponential moving averages, which suggest prices could drag further.

Furthermore, after testing Rs 1,450 levels on the higher side, the stock once again fell back towards Rs 1,350 levels and sustaining well below its trendline resistance.

The stock may be sold in the range of Rs 1,362 - 1,372 for the target of Rs 1,285, and keep a stop loss above Rs 1,415.

MORE WILL UPDATE SOON!!

Subscribe to:

Comments (Atom)