Kotak Mahindra Bank (Kotak Bank) reported a steady quarter in a rather challenging environment with impeccable execution as always. Kotak Bank is clearly a top-class financial conglomerate from India. Its risk-adjusted strategy of growth and focus on building a strong liability should help it to weather turbulent times in the financial system, much better than most of its peers. This is, however, reflected in the premium valuation of the stock. A must-own scrip in the core portfolio of investors, look to accumulate this stock on every weakness of the market or any adverse news flow pertaining to the promoters’ stake dilution in the ongoing legal battle between the regulator and Kotak Bank.

In the quarter gone by, core performance remained healthy with net interest income as well as non-interest income (driven by fees) growing well.

Key positives

Turning to the reported numbers of the standalone bank first – the growth in net interest income (difference between interest income and interest expenses) was ahead of loan growth thanks to an improvement in interest margin. The net interest margin of the bank stood at 4.49 percent – an improvement of 19 basis points YoY and 1 basis point sequentially. The management attributed this to better risk-adjusted returns on lending and a steady improvement in the liability profile.

The deposit franchise continues to impress. While the banking system is struggling to garner low cost deposits (CASA or current and savings account), for Kotak Bank, CASA grew at a faster clip than overall deposits and formed 50.7 percent of overall deposits – clearly one of the best in the industry, despite the quarter-on-quarter moderation. If one were to include the term deposit sweep of 7 percent, the share of non-costly deposits rises to 58 percent. The bank has recently reduced interest rate on savings deposits below Rs 1 lakh, which should boost the net interest margin.

The credit-to-deposit ratio has also been gradually moderating which should help it bag growth opportunities in the future without compromising on margin.

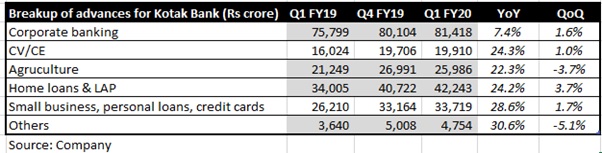

On the advances front, the growth of 17.6 percent was led by consumer banking and commercial vehicles. Corporate and SME growth were subdued. The bank is confident of achieving 20 percent credit growth in FY20.

In terms of market share, Kotak Bank has been gaining both on the deposits and advances front. In advances, its incremental market share stood at 3 percent last year, much higher than its absolute share of 2.2 percent, indicating market share gains. In deposits too, the bank’s incremental market share at 3.8 percent was much higher than absolute share of 1.9 percent.

Asset quality remained stable with the ratio of gross and net NPA at 2.19 percent and 0.73 percent respectively. The provision cover stood at a healthy 67 percent.

The bank is well capitalised with the Capital Adequacy Ratio at 17.8 percent (Tier I is 17.3 percent) which should take care of future growth opportunities. Given the challenging financial sector landscape that has impacted both PSU banks as well as NBFCs in a big way, Kotak is regaining pricing power and seeing better risk-adjusted returns in the market place and is in a vantage position to grab market share.

The group’s consolidated profit grew by 23 percent driven by other key subsidiaries like Kotak Mahindra Prime, Kotak Life Insurance, Kotak Securities, Kotak AMC etc. The investment banking arm Kotak Mahindra Capital had a very strong quarter.

Key negatives

Special Mention Accounts (SMA2, where principal or interest payment are overdue between 61-90 days) stood at 16 basis points, a tad worse than 7 basis points in the previous quarter which could be indicative of a deteriorating macro.

The Business banking and corporate banking business continued to remain subdued.

Then, there is the overhang of RBI’s directive for diluting the promoters’ stake to 20 percent. The matter is currently sub-judice.

Outlook

The well-capitalised balance sheet of Kotak Bank, the stable and sustainable low cost liability, focus on risk-adjusted returns in lending, the opportunity to gain market share and thriving non-banking businesses in subsidiaries make Kotak Bank a must own in any core portfolio of investors. The valuation at 4x FY20e banking book factors in most of the positives and the bank’s superior positioning. So investors must add this stock in the event of any negative news flow or market turbulence.

MORE WILL UPDATE SOON!!

Please share your views and comment

ReplyDeleteWhats App No :91+7568143768

Email: arun1991s@gmail.com

ARN-135186 and EUIN - E226370