Most companies on the list have either a buy or an add rating.

Warren Buffett once said be fearful when others are greedy and be greedy when others are fearful. Well something similar is happening in the small and midcaps space that has suffered some big cuts so far in 2018.

The Sensex is up 4 percent in 2018 compared to a 13 percent and about 17 percent fall in the BSE Midcap and Smallcap indices, respectively.

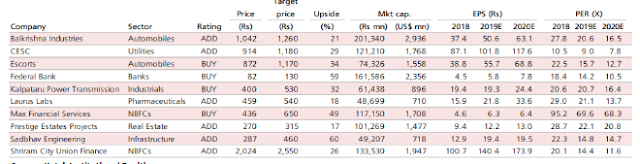

After the recent correction, Kotak Institutional Equities re-introduced its midcap portfolio focussing on 10 stocks. These include: Balkrishna Industries, CESC, Escorts, Federal Bank, Kalpataru Power Transmission, Laurus Labs, Max Financial Services, Prestige Estates Projects, Sadbhav Engineering and Shriram City Union Finance.

Most companies on the list have either a buy or an add rating by the brokerage. It set the most aggressive target price on Sadbhav Engineering, which has the potential to offer up to 60 percent return in the next 12 months.

We continue to follow a ‘barbell’ approach which is a mix of expensive ‘growth’ and inexpensive ‘value’ stocks noting extreme valuations across and within sectors. We introduce our midcap portfolio after the recent steep correction in valuations of midcap stocks. We still find valuations of midcap consumer stocks to be quite expensive and are avoiding the same despite their relatively better longer-term growth prospects," the brokerage said.

Valuations of the broader market are still expensive versus historical levels and bond yields despite projected strong growth in net profits over FY18-20 led by normalisation of profits in a few sectors and economic recovery.

The market’s valuations are largely supported by ‘growth’ stocks in consumption sectors while the valuations of remaining sectors are fairly reasonable and even attractive in a few cases.

There is deep value in several cases based on our fair valuations after the severe correction in those names in the past six months, it added.

It said global issues (trade, sanctions) still pose meaningful risks to India’s macros in case trade tensions were to escalate.

MORE WILL UPDATE SOON!!

0 comments:

Post a Comment