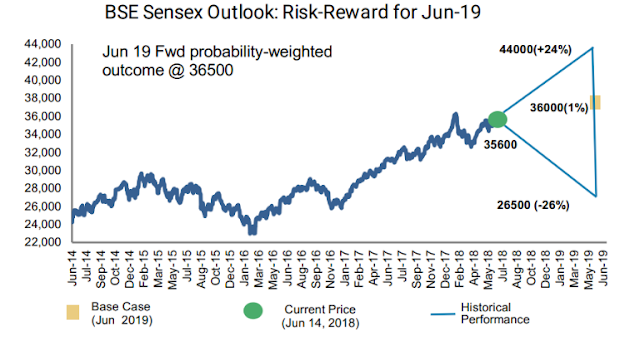

In a bear case scenario, Morgan Stanley sees a 20 percent probability of the Sensex heading lower to 26,500 levels.

Global investment bank Morgan Stanley has a June 2019 Sensex target of 36,000 under its base case scenario. This means the index would trade below its historical average at just under 16 times one-year forward price-to-earnings. It said factors like improving growth, reasonable largecap valuations and low beta are up against an election year, rising oil prices and higher yields.

In a bull case scenario, it sees a 30 percent probability of the Sensex rallying towards 44,000. “Better-than-expected outcomes, most notably on the policy and global front will result in such an upmove. The market starts believing in a strong election result and earnings growth accelerates to 29 percent and 26 percent in FY19 and FY20, respectively.”

In a bear case scenario, it sees a 20 percent probability of the index heading lower to 26,500 levels “if global conditions deteriorate and the market starts pricing in a poor election outcome and Sensex earnings grow at 21 percent and 22 percent in FY19 and FY20, respectively.”

The global investment bank prefers largecaps over midcaps. The brokerage is positive on banks (private corporate and retail), discretionary consumption, industrials, and domestic materials, while avoiding healthcare, staples, utilities, global materials and energy.

India's low beta and its implications

The global investment bank said in its India Equity Strategy note that India is a likely outperformer even as absolute returns are capped by a tepid global equity market outlook. “The market is now recognising India macro's growing stability compared to emerging markets as is evidenced by the 37 percent fall since December 2014 in the country's beta to a 13-year low. The implications include case for a positive surprise in equity returns for India (as expectations are now low going by the beta level), with likely outperformance for India versus EM in a low return world.”

In addition, India's relative falling short rates, rising relative growth rates and a dip in positioning by foreign portfolio investors to 2011 levels add to the outperformance case, Morgan Stanley added.

Valuations

Morgan Stanley does not feel the Sensex or Nifty are pricing in a multi-year growth cycle, implying meaningful upside potential to stocks over the next three to five years. “For long-term investors, valuations are still in the comfort zone. Relative valuations are attractive and around average, but midcap valuations are still looking stretched despite the recent drawdown,” it stated.

Stocks in focus list:

MORE WILL UPDATE SOON!!

0 comments:

Post a Comment