The midcap space is under some selling pressure as the market breadth has remained negative almost every day in the last week. If the Nifty is able to retain 10,800 this week, we can start witnessing buying in midcap stocks.

Volatility in the Indian market has not seen any major surge before the Karnataka elections compared to the 20 percent witnessed in February.

This means market participants are not factoring in any major negativity post the event and the current consolidated positive bias may continue

The midcap space is under some selling pressure as the market breadth has remained negative almost every day in the last week. If the Nifty is able to retain 10,800 this week, we can start witnessing buying in midcap stocks.

Nifty PCR-OI has increased from 1.50 to 1.55, which means Put writers are more active leading to the base formation at higher levels in the market.

The highest Put base is placed at 10,500 and Put writing positions have also increased at 10,600 strikes. On the higher side, the highest Call base remains at 11,000, the level towards which the Nifty is likely to approach in coming sessions.

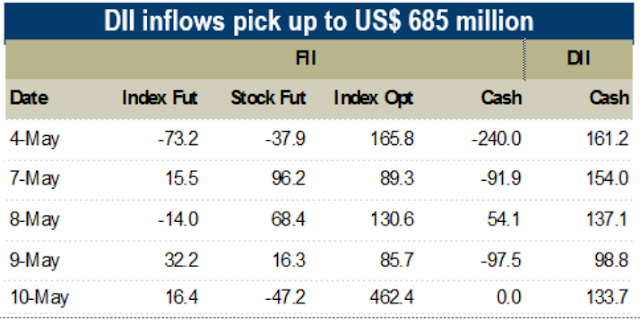

Support of domestic institutions is helping to withstand the selling seen from FIIs. This trend is expected to continue in the event of rupee depreciation.

The stock-specific scenario may continue amid the earnings season. So far, non-banking midcaps have fared relatively better.

Bank Nifty: Upside likely to continue

The index continued its outperformance compared to the broader market and the follow-up rally seen for the second straight week.

However, on the weekly expiry day, marginal profit booking was seen but the index made up its losses on Friday and ended at the highest levels since February 2018.

The index has turned into a discount on the back of short additions as the open interest in the index rose nearly 33 percent for the week.

However, we feel short positions are stuck. Unless we see any major closures in open interest, these upsides are likely to continue

In the options segment, 26,000 Put has seen sizeable additions whereas on the Call side 26,500 and 26,700 are active strikes.

We feel these short positions will look for an exit near the sizeable Put base of 26,000, which is likely to act as a cushion to the index whereas on the upside, 26,500 is the immediate target and a close above these would open more upside.

The current price ratio (Nifty/Bank Nifty) has been hovering near 2.42. We feel the index is likely to remain volatile ahead of the Karnataka elections. However, looking at the outperformance in banking stocks, we feel the ratio is likely to approach 2.47 levels in coming days with support near 2.40 levels

Cool-off in dollar, bond yield surge may set risk-on tone for EMs

The risk environment for equities improved in the second half of the week as the magnitude of dollar and bond yield surge tapered off. During the week, MSCI EM Index was up over 2 percent outperforming developed market equities that moved up 1 percent.

Weakness trend of EM currencies abated somewhat (after falling sharply in previous five consecutive weeks) and was the main trigger for up move in EM equities.

On a YTD basis, MSCI EM Index is flat but from its highs in January 2018, it is still 9 percent lower, leaving room for upsides.

The initial up move in equity of EM space seems due to short covering/domestic buying driven as FII selling continued in most of the EMs. While the quantum is still not very high, outflows are seen from most key EMs during the week.

From India, FIIs withdrew over USD 400 million. In other EMs, outflows of over USD 895 million were seen from Taiwan. Outflows were also seen from South Korea (USD 190 million), Indonesia (USD 84 million) and Thailand (USD 208 million)

Back in the F&O set up for the Nifty & stocks, FIIs reduced their cautious undertone. There was short closure in index future to the tune of USD 23 million. However, the index option buying increased to USD 933 million.

In the last couple of sessions, the dollar and bond yields have cooled off post softer US inflation (CPI) and a strong 30-year auction.

Bank of England also adopted a less hawkish tone by not hiking rates. As a result, risk appetite rose overnight with US core inflation and unchanged Bank of England both signalling only a gradual normalisation in interest rates.

This backdrop is particularly good for equities as they like contained inflation/rates environment. The traces of the same were visible on US VIX level, which came in below key support level of 14 to close at 13.2.

Hence, a recovery in EMs and FIIs stance towards EMs is not ruled out in the coming week. Crude & dollar will continue to remain on the watchlist.

MORE WILL UPDATE SOON!!

0 comments:

Post a Comment