In case of no negative surprise, Nifty would continue to form base near 11,000 and this uptrend should continue. However, there has been some weakness seen in the midcap space which is not visible looking at the Nifty prices.

The Nifty has started closing above 11,000 levels amid some volatility. Before Budget announcement on February 1, we can see further short covering which can take Nifty higher towards 11,200.

In case of no negative surprise, Nifty would continue to form base near 11,000 and this uptrend should continue. However, there has been some weakness seen in the midcap space which is not visible looking at the Nifty prices.

The reason being the market participants were quite overboard on the midcaps instead of largecap stocks. This is where profit booking is quite visible in this space before the major Budget announcement.

The support from private banking and other non-banking heavyweights is continued. The first leg of profit booking was seen in IT heavyweights after continuous move in January series. These stocks are expected to pick up momentum back after a while.

The volatility has risen before the event. This is the same pattern what was seen before the last budget announcement in 2017.

After the Budget in 2017, volatility had cooled-off quite sharply from 17 percent to 12 percent within few sessions. We believe the same decline may be seen this time around in absence any major event after this.

The roll spread in Nifty turned negative from 25 points on the expiry day which shows rollover of short positions in the index. Sustainability of Nifty above 11000 post-budget should lead to short covering in the index.

Nifty Bank:

After re-writing history books, the Bank Nifty index ended at a new life high by moving above 27000 levels in the January series with broad-based participation in private as well as public sector banks.

Participants booked marginal profits in PSU stocks after the government moves to infuse more Capital.

The intraday volatility can be high ahead of the Union Budget 2018 and sharp intraday whipsaws can be seen going ahead as the volatility index has seen its sharpest up-move in the last few months and rose to 18 percent from 11 percent.

Rollovers were in line with the expectations and the short rolls is also seen for the February series. We feel in case of any major fall, this short positions will be covered which will further provide a cushion to the index and in absence of any negativity from the budget, we feel the index is likely to witness support near 26900 levels.

The current price ratio (BankNifty/Nifty) is near 2.47 levels. We feel the ratio is likely to move towards 2.52 levels on the back of outperformance in banking stocks whereas, on the lower side, support for the same can be seen near 2.43 levels.

Risk-on sentiment continues to drive FIIs inflows:

Melt up in equities continues unabated with MSCI world Index up 7 percent in 2018 (1.5 percent in a current week) and MSCI EM Index up 9 percent in 2018 (2 percent in a current week).

Money flow has strongly supplemented this flow as bond markets continue to grapple with higher bond yields and the bulk of incremental fund flows are seen in equity segment and that holds true for emerging markets as well.

YTD inflows in Indian equities have aggregated close to the US $ 1.6 billion already (1.1 billion in last 5 days) and other EM-like Taiwan & South Korea also has seen inflows of US $ 2.5 billion each.

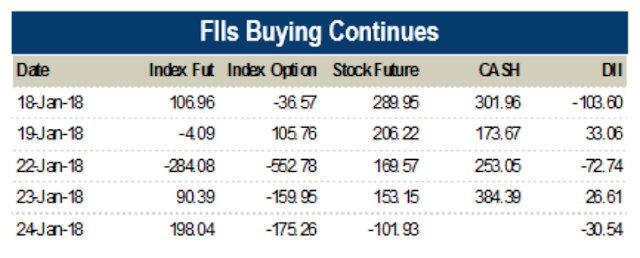

In the F&O segment as well, there was bullish stance by FIIs, as they bought Index Futures worth over the US $ 100 million and Stock futures worth in the US $ 750 million.

Despite India VIX moving to 18 levels, there was option selling worth over the US $ 850 million, suggesting a bet on a strong January series expiry).

Rise in yields in the bond market has still not made inroads into long-dated part of the curve (e.g. US 30Yr) (where major bond portfolio lies) and hence the weak dollar story continues to ramp up strong EM FX and resultant strong EM equities.

This trade is strongly anchored into Dollar weakness and as long there is no swift and sharp reversal to dollar strength, the EM risk-on rally will continue to have a strong tailwind.

However, the key risk for the equity segment remains the sharp up move in 2018 already (the current rally has the strongest start to any year in a long time frame) and some profit taking around current levels.

MORE WILL UPDATE SOON!!

0 comments:

Post a Comment