Performance//S&P 500 Analysis/DOW 30 Analysis /Nasdaq 100 Analysis/Indian Market Analysis

PERFORMANCE:

Last week we had given call to buy Ashok Leyland (future) around 116.50--116.00 for target of 120--122 with Stop Loss of 113.I am glad to tell you that both our target were hit today and we were able to mint profit.We booked profit of Rs 38500 on 1 lot or return of 4.72% in 1 lot in just 1 week.Hope our call proved fruitful.

Today we also recommended to buy Bharti Airtel (Future) around 494 for target of 500 with stop loss of 490.Our called proved fruitful again and we were able to book profit of Rs 10200 in 1 Lot or return of 1.21% with a day in 1 lot.Hope you booked profit.

Today we also recommended to buy Kridhan Infra (cash) around 100 for target of 105--109 with stop loss of 97.Our called proved fruitful again and we were able to book profit and made return of 5% with in a day.Hope you booked profit.

We had also recommended to buy SREI Infra (cash) around 105--104 for target of 109 with stop loss of 102.Our called proved fruitful again and we missed our target by a whisker of 1.05 as it made high of 107.95.Hope you were still able to mint profit still.

Rest all call remains intact.....Maintain Stop loss and patience is the key

We had also recommended to buy SREI Infra (cash) around 105--104 for target of 109 with stop loss of 102.Our called proved fruitful again and we missed our target by a whisker of 1.05 as it made high of 107.95.Hope you were still able to mint profit still.

Rest all call remains intact.....Maintain Stop loss and patience is the key

S&P 500 and NASDAQ 100 Forecast

S&P 500

The

S&P 500 was relatively quiet during the trading session on Friday, as we

had a shortened day on Wall Street. By breaking above the 2600 level though, it

looks as if we are ready to go higher, and I think that short-term pullbacks

will be nice buying opportunities for a market that has obviously been in an

uptrend. By breaking above the 2600 level, we have cleared a bit of resistance,

and I suspect that traders will continue to go long as we open on Monday.

Longer-term, we will go to the 2650 level, and I think that the 2590 level

underneath will be the bottom of significant support. With the US dollar

falling in value, it’s likely that the S&P 500 will continue to go higher

based upon the cheapness of US exports.

The 24-hour

exponential moving average continues to offer significant support dynamically,

every time we break above a, and technically speaking, it looks as if we are

ready to go higher but we are likely needing to find value on those pullbacks.

If we were to break down below the 2490 handle, I think that the market

probably could go as low as 2580 next, but we should find even more support in

that general region. In general, I am bullish of stock markets overall, as

there seems to be a lot of algorithmic trading taken advantage of the bullish

pressure that we have seen. Every time we dip, the buyers come rushing back,

and quite frankly on Wall Street, it’s not uncommon to see the market open

lower in the morning, and to find buyers later in the day. Until this pattern

stops, I don’t see this market breaking down anytime soon. Buying continues to

be the best way forward.

Dow Jones 30

The Dow Jones

30 initially went sideways during the trading session on Friday, popping just a

bit, pulling back again, and then finding enough support at the 23,500 level to

rally significantly. Because of this, it’s likely that the market will continue

to find buyers underneath, and I think that the short-term pullbacks are going

to continue to be picked up by algorithmic traders as well, as a “buy every

dip” mentality has taken over Wall Street. The 23,500 level is very important,

and if we break down below there I think we could drop another 250 points

rather quickly. Overall, I think that we will eventually reach towards the 24,000

handle above, which of course has a certain amount of psychological importance

as well. The Dow Jones 30 continues to plow along to the upside, and therefore

I have no interest in shorting.

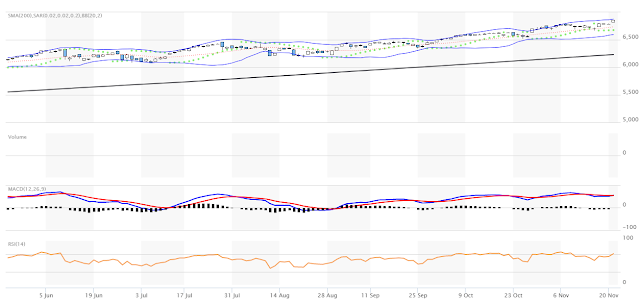

NASDAQ 100

By breaking

above the 6400 level late during the trading session on Friday, the NASDAQ 100

looks very likely to continue the uptrend and go looking towards the 6450 level

above. I think that pullbacks continue to find support at the 6380 handle, and

that value hunters will be attracted to the NASDAQ 100 as it has shown so much

in the way of resiliency. The stochastic oscillator is in the overbought area

on the hourly chart, so a short-term pullback could present itself rather

quickly. However, that pullback offers value, and if we can stay above the 6380

handle, there’s no reason to think about shorting this market. Longer-term, I

anticipate that the 6500 level is going to be targeted, but that’s going to

take a significant amount of time to get to. This will be especially true as we

head into the holidays.

MARKET UPDATE:

Late recovery helps Sensex, Nifty close higher for 8th consecutive session

--The

broader markets outperformed benchmarks with the Nifty Midcap rising half a

percent. The market breadth was positive as about three shares advanced for

every two shares declining on the BSE.--

--Equity benchmarks managed to

extend uptrend for the eighth consecutive session Monday, with the Nifty

reclaiming 10,400 level intraday led by late rebound in banking &

financials. The market opened lower after the S&P reaffirmed India rating

and weak Asian cues, but recouped losses in last hour of trade.--

--The 30-share BSE Sensex rose

45.20 points to 33,724.44 and the 50-share NSE Nifty gained 9.80 points at

10,399.50.--

--The market continued its uptrend

but there could be volatility in coming sessions ahead of expiry of November

derivative contracts, experts suggest.--

--The broader markets outperformed benchmarks

with the Nifty Midcap rising half a percent to end at record closing high. The

market breadth was positive as about three shares advanced for every two shares

declining on the BSE.--

--Nifty Bank also ended at fresh record closing

high of 25,891.95, up 0.44 percent. Axis Bank was up 2.55 percent as The Essar

Group will repay debt of various financial institutions including Axis Bank

through BPO business (Aegis) sale proceeds.--

--HDFC Bank, SBI, Kotak Mahindra Bank and Yes

Bank gained 0.4-1 percent.--

--L&T rose half a percent as its

construction subsidiary has bagged orders worth Rs 3,572 crore under

transportation infrastructure, metallurgical & material handling, power

transmission & distribution, and buildings & factories segments.--

--Oil India was up 1.3 percent and ONGC rallied

1.7 percent. Credit Suisse upgraded Oil India to outperform from neutral & raised target price to Rs 425 while it maintained outperform rating on ONGC

with increased target price at Rs 220 (From Rs 190 per share).-

--"Oil around USD 60 per barrel is a sweet

spot for both ONGC and Oil India with strong earnings and low subsidy risk in

FY19," the research house said while raising EPS estimates for ONGC/OIL

for FY18/19 by 8/2 percent and 10/9 percent, respectively.--

--Oil marketing companies - HPCL, BPCL and IOC

were under pressure, falling 0.5-1.5 percent on marketing margin concerns.--

--NTPC, Bharti Infratel and Zee Entertainment

among others gained 2-3 percent whereas Infosys, Tata Motors, Adani Ports,

IndusInd Bank and Ambuja Cements fell around a percent each.--

--Mindtree jumped 7 percent as Credit Suisse

upgraded the stock to outperform and increased target price on earnings growth

hope.--

--Gujarat Heavy Chemicals surged 10 percent as

DSP Blackrock Mutual Fund bought 9,50,528 equity shares at Rs 272 per share

through a block deal on Friday.--

--Renewable energy stocks like Inox Wind, Suzlon Energy and

Swelect Energy gained 6-11 percent while real estate stocks - Indiabulls Real,

Mahindra Lifespace, Nitesh Estates and Peninsula Land surged 6-18 percent.--

MORE WILL UPDATE SOON!!