Nifty 50,Bank Nifty,Market Update

Nifty 50

Nifty is looking extremely bullish on charts and

all the indicators suggest that a rally is waiting ahead.On our previous blog

we clearly indicated that Nifty has resistance around 10350--10380 and we saw

Nifty struggle in that region throughout the week and hence closed in at

10390.We saw Nifty gain for five straight session and also saw a tussle between

the bulls and the bears throughout the week with bulls emerging as winner.Now

what to expect next week.Since India has been waiting for a sharp upside momentum

news in the name of India rating upgrade by S&P which maintained a stable

outlook for India as most position in the last trading session was made in this

anticipation for a gap up Nifty open but now it may not be the case,One also

has to understand that rating has important implication for the bond market but

"who are we kidding" all market especially Indian stock markets are

driven by sentiments and therefore we may expect a downside open on Monday as a

temporary setback and every dip on the market should be used to build a long

term position or as an buying opportunity.

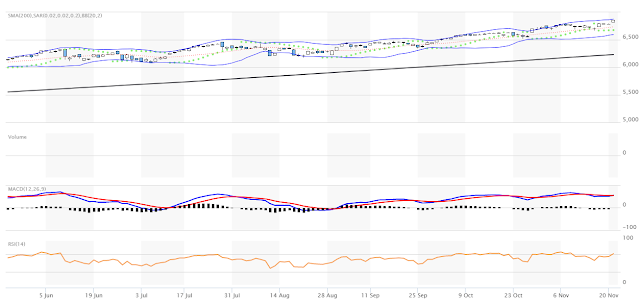

Nifty is looking extremely stable in charts and

making a case for all time high breakout which we may see before the expiry in

the upcoming week ahead.RSI of 61 and increasing also indicate that Nifty 50

may soon enter an overbought zone with rise in volumes and one should not trust

the bears if they start to show some panic in the start of the week as trend is

clearly that of upside. MACD is also heading towards a positive crossover and

this will make the trend positive for short term to come and expect sharp

upside in December .

Immediate Supports Nifty 50 is in the range of 10350.Below this lower support lies around 10260 levels.Immediate Resistance lies around 10420.If these resistance are positively breached and sustained then one may see Nifty testing (10450--10500)+ mark in upcoming week ahead.

Bank Nifty

Bank Nifty looks highly stable in charts and

this week we saw Bank nifty in consolidation mode and form a case of an upside

breakout for making new all time high in charts and seems to be heading towards

a positive breakouts to make new lifetime highs above 257900 level and now

currently trading at 25779.If Bank Nifty is able to give consecutive closes

above 25700 level or able to consolidate in the range of 25700--25625 then we

may see more upside as every dip in Bank Nifty should be used as an buying

opportunity with stocks like Yes Bank and Kotak Mahindra Bank ,ICICI Bank

,Canara Bank to mint money in short to medium term basis.

Although the fact that S&P rating for India

remained stable we may see a negative sentiment at the start of the week and

see some downside and bears will try to take full opportunity of this scenario

to drag the index downward but one should not trust the bear as we may see

sharp short covering if this case persist as all other technical indicators

suggest a positive outlook for bank nifty in the upcoming week ahead.RSI of 64

and increasing also suggest that a bull run may be waiting ahead and we may see

sharp upside if RSI enters into overbought territory. MACD with a positive

divergence of 10.45 also indicate that an upward trend lies ahead in Bank Nifty

for short term to medium term basis.Bank Nifty has immediate Support levels

around 25625--25500.Below this lower support building around (25200--25150)

level.Bank Nifty has immediate resistance around (25850--25900).If the

mentioned level is positively breached and sustained and consecutive closes

above these level takes place then we will see sharp upside rally in bank nifty

as bank nifty will break its consolidation mode and enter new regions to make

new life time high.

Market Update:

--Tech leads S&P above 2,600; Amazon, other retail stocks gain.----The Dow rose 31.81 points, or 0.14 percent, to 23,557.99, while the S&P gained 5.34 points, or 0.21 percent, to 2,602.42. The Nasdaq added 21.80 points, or 0.32 percent, to 6,889.16.--

--Technology stocks led the S&P 500 and Nasdaq to record closing highs on Friday, with the S&P ending above 2,600 points for the first time, while Amazon and retail stocks got a boost from signs of a strong start to the holiday shopping season.--

--The benchmark S&P 500 and the blue-chip Dow Jones industrials posted weekly gains for the first time in three weeks while the Nasdaq Composite posted its best weekly performance since the week to September 1.--

--The stock market had a half session on what is known as Black Friday, the day after the Thanksgiving holiday and the unofficial start of the US holiday shopping season.--

--US stores offered deep discounts, entertainment and gifts to draw bargain hunters, but some shoppers said they were just eyeing goods, reserving their cash for online purchases.--

--On Thursday, Thanksgiving Day, US shoppers spent more than USD 2.87 billion online, according to Adobe Analytics.--

--Adobe, which measures 80 percent of online transactions at the largest 100 US web retailers, forecast online Black Friday sales of USD 5 billion, which would be a record high. Online retailers could rake in an additional USD 6.6 billion on Cyber Monday.--

--The S&P retail index rose 0.75 percent and hit a record intraday high, led by Amazon’s 2.6 percent gain.--

--Brick-and-mortar stores, which have been boosting their online presence, also fared well.--

--Kohl’s Gap and J.C. Penney were up between 0.6 percent and 1.6 percent.--

--Target ended 2.8 percent lower at USD 55.88, with analysts noting that it closed its stores for several hours overnight while rivals stayed open. Wal-Mart inched up 0.2 percent.--

--The CBOE Volatility Index better known as the VIX and the most widely followed barometer of expected near-term stock market volatility, closed at 9.67, nearly a three-week low. Just after the stock market closed at 1 p.m. New York time (1800 GMT), the VIX fell to 8.56, ostensibly a record intra-day low.--

--The energy index and the materials index were boosted by rising commodities prices.--

--US oil prices jumped to a more than two-year high as North American markets tightened on the partial closure of a key pipeline linking Canada and the United States.--

--About 2.78 billion shares changed hands in US exchanges in the shortened session. The daily average over the last 20 full sessions is 6.48 billion shares. Last year, volume during the session after Thanksgiving was 3 billion shares.--

--Advancing issues outnumbered declining ones on the NYSE by a 1.61-to-1 ratio; on Nasdaq, a 1.31-to-1 ratio favored advancers.--

--The S&P posted 35 new 52-week highs and one new low; the Nasdaq recorded 120 new highs and 21 new lows.--

MORE WILL UPDATE SOON!!