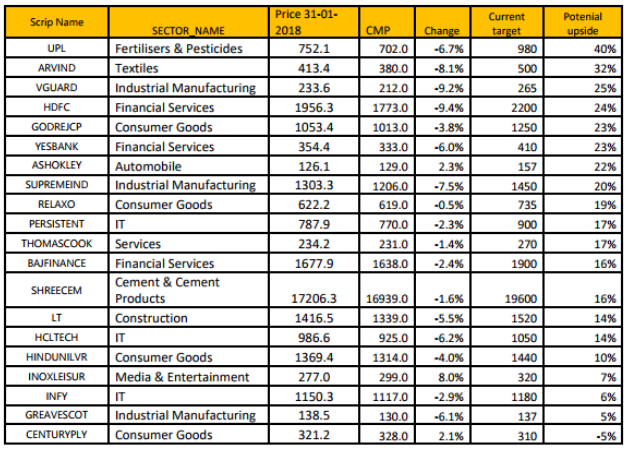

Does correction on D-St warrant a portfolio reshuffle? 12 stocks to buy

top buys in the large caps space include names like Maruti Suzuki, ICICI Bank, Motherson Sumi, HPCL, Hindalco Industries, Aurobindo Pharma, Bharat Electronics and Ashok Leyland.

The Nifty50 corrected 5.7 percent from its lifetime high of 11,130 (on January 29, 2018), led by global sell-off and on profit booking by the market, post introduction of Long Term Capital Gains (LTCG) tax in Union Budget FY19, IDFC Securities said in a note.

The budget focused on rural growth, infrastructure push, employment creation, MSME (Micro, Small and Medium Enterprises) support and social welfare, which was in line with expectations and is expected to support lower income groups in general.

The domestic brokerage firm believes that two themes would predominantly play out as the economy recovers: a) Asset-heavy and export-oriented industries would do well as the global economy recovers and consequently, the valuation gap between asset-heavy and asset-light industries would narrow further, and b) Consumption being the strongest component of GDP will continue to see growth impetus from retail credit.

Moreover, the recent reduction in tax rates for companies operating in the discretionary consumer sector will boost overall consumption.

Consequently, IDFC Securities is Overweight: Engineering and Capital goods, Construction, Metals & Mining, Oil & Gas, Consumer Goods, Automobiles, Media, and Pharmaceuticals; Neutral: Banks, Cement, Chemicals, Power and IT; Underweight: Real Estate and Telecom.

IDFC Securities has made some changes in its portfolio of stocks. It replaced SBI with ICICI Bank within top picks, and ONGC with Maruti Suzuki India Ltd.

IDFC top buys in the large caps space include names like Maruti Suzuki, ICICI Bank, Motherson Sumi, HPCL, Hindalco Industries, Aurobindo Pharma, Bharat Electronics and Ashok Leyland. In the small and midcaps space stocks such as Kajaria Ceramics, SpiceJet, Ashoka Buildcon, and Greenply Industries are looking attractive.

Here is a list of top 12 stocks

Maruti Suzuki: Buy | Target: Rs 10,500

As Maruti Suzuki continues to gain market share, it again underpins its strong competitive position. Successful product launches coupled with declining competitive intensity reinforces the company’s dominance in the market.

While profitability has been weak in the Q3 FY18, going forward we expect margins to improve on the back of better operating leverage and an improving product mix.

Also, the company will start production of batteries FY 20E onwards in a joint venture with Suzuki, Toyota, and Denso, with increasing focus on electric vehicles.

IDFC Securities values the company at 26x FY20 led by stronger earnings visibility (royalty payments are likely to decline with logistic savings on vendor localization and fast ramp-up of Gujarat plant).

ICICI Bank Ltd: Target: Rs 390

IDFC Securities added ICICI Bank to their top picks as it believes: a) Slippage going ahead will be less volatile compared to what we observed in the previous years, b) margins have bottomed out. Moreover, ICICI Bank has managed volatility in stress loans better than other private corporate banks.

Also, the loan growth continues to be healthy (domestic loans grew by 16 percent YoY and 6 percent QoQ in Q3 FY18). With latest earnings release, we have revalued non-banking subsidiaries with a value of core business at 1.3x PBV FY20E, thereby increasing our target price to Rs 390.

Motherson Sumi Systems: Target: Rs 425

Motherson Sumi expects to achieve its revenue target of USD 18 billion a year before than earlier targeted for 2020. Also, in the last few years, SMR/SMP have consistently gained market shares across product segments and the company has entered new verticals with the acquisition of PKC.

Moreover, further growth drivers persist as (a) the company has enough whitespaces to grow with existing customers, b) overall growth in the premium car market is likely to outstrip lower-end vehicles, c) content per vehicle continues to rise with the share of electronics improving.

HPCL: Target: Rs 515

IDFC Securities believes that improved refinery configuration, higher marketing margins, and rising cash flows do not yet reflect in HPCL’s valuations.

In refining, the brokerage house believes that the reasons for miss compared to estimates in Q2 will not spill over into H2 and the improving distillate yields, higher sulphur crude and improving configuration should lead to GRMs sustaining at over USD 7/bbl (FY18-20E).

While growth in marketing volumes remains below historical levels, OMCs are expected to benefit from higher-margin LPG replacing lower-margin kerosene over FY18-19E. Moreover, with ONGC taking a stake in HPCL, if ONGC allows HPCL to absorb MRPL, the overall refining complexity of HPCL would see a sharp improvement.

Hindalco Industries: Target: Rs 346

With clarity on aluminium hedging volumes and prices in FY19 and its CoP peaking soon, we expect Hindalco’s (HNDL) EBITDA to rise 29 percent YoY to Rs 78 billion in FY19E from its India operations. Moreover, Novelis’ sustainable EBITDA guidance of USD 375-380/t provides comfort on its future earnings.

Hindalco’s capex plans in value addition and alumina expansion are key positives. We have not factored in any probable acquisition by Novelis in our estimates. Post Q3 FY18 earnings, IDFC Sec have rolled over their valuation to FY20E earnings to arrive at a target price of Rs 346 (earlier Rs 322).

Aurobindo Pharma: Target: Rs 944

Aurobindo reported steady earnings growth versus most peers in FY17-18, disproving apprehensions on the company’s US generics focussed business model. The company’s US sales grew 28 percent QoQ to USD 327 million in Q2 FY18, aided by gRenvela launch.

We estimate 13 percent CAGR from US sales over FY17-20E to USD 1.45 billion in FY20E, despite likely erosion in oral solid dosage (OSD) portfolio. Growth in US sales will be driven by 33 percent CAGR in injectables, new niche OSD launches and scale-up in Natrol and OTC segments over FY17-20E

Additionally, EU profitability will drive 11 percent PAT CAGR over FY17-20E with significant operational cash generation. Aurobindo is our top pick in the largecap pharma space.

Bharat Electronics Limited: Target: Rs 220

BEL is well-positioned to capture the growing defence spend, led by its strong manufacturing capabilities and R&D focus. Accordingly, IDFC Securities expect order intake momentum to sustain at Rs150bn on an annual basis over the next few years, providing strong revenue visibility with a current order backlog of Rs 405 billion (4x FY18E revenues).

As execution picks up (22 percent revenue CAGR over FY17-20E), we expect margins to remain stable, led by positive operating leverage.

While the near-term earnings growth is impacted by lower other income (buyback and lower yields, 3 percent growth in FY18E), IDFC Sec expects long-term earnings trajectory to be strong (18 percent CAGR over FY18-20E).

The stock trades at attractive valuations along with sustained order inflows, long-term earnings potential, and improvement in return ratios.

Ashok Leyland Ltd: Target: Rs 138

We believe the CV cycle has not peaked and expect volume growth recover in H2 FY18E. We expect a) an improvement in mining/road construction sectors, b) stringent regulation on overloading in UP, and c) defence tenders to drive growth.

Moreover, we are convinced about Ashok Leyland’s improving competitiveness and increased focus on exports/LCVs, which we believe de-risk its business. We expect these initiatives to drive revenues (12 percent CAGR over FY17-20E, backed by 8 percent M&HCV volume growth and 4 percent improvement in price realization) while reducing cyclicality over FY17-19E.

Kajaria Ceramics: Target: Rs 776

IDFC Securities believes that organised players will continue to gain market share from unorganised players, led by GST implementation (tax compliance) in the medium term.

However, in the near term, unorganised players have gained given the delay in the introduction of the e-way bill. This along with a sharp increase in fuel prices has led to cut our estimates sharply.

IDFC Securities now estimate 14.6 percent volume CAGR (depressed base) and strong 27.5 percent earnings CAGR over FY18-20E on the back of operating leverage kicking, JV issues getting sorted and higher contribution of sanitaryware/faucet division.

With industry-leading market share, margins and high return ratio profile, we expect the stock to command industry leading multiples (provided growth does not decelerate).

SpiceJet: Target: Rs 173

SpiceJet continues to invest in rebuilding its brand and in improving its service offerings. Its bold route strategy involves a greater focus on non-trunk routes, has strong growth prospects and is already earning the company better yields. Driven by 21.5 percent/24.9 percent RPKM/revenue CAGR and stable gross spreads, we expect 26 percent/32 percent EBITDA/EPS CAGR for SpiceJet over FY17-19E.

Also, we believe SpiceJet’s balance sheet will continue to strengthen with strong cash generation (expect net cash position by Mar 2019). The stock trades at 8.1x FY19E EV/EBITDAR and we value SpiceJet at 9.3x FY19E EBITDAR (5 percent discount to multiple assigned to IndiGo).

Ashoka Buildcon: Buy | Target: Rs 312

IDFC Securities believes that organised players will continue to gain market share from unorganised players, led by GST implementation (tax compliance) in the medium term. However, in the near term, unorganised players have gained given the delay in the introduction of the e-way bill.

This along with a sharp increase in fuel prices has led to cut our estimates sharply. IDFC Securities now estimate 14.6% volume CAGR (depressed base) and strong 27.5 percent earnings CAGR over FY18-20E on the back of operating leverage kicking, JV issues getting sorted and higher contribution of sanitaryware/faucet division.

Greenply: Target: Rs 390

IDFC Securities expects Greenply to benefit from the recent boost in GST (lowered to 18 percent), which will accelerate the shift in market share towards organised players. Also, ongoing revival in real estate will aid growth, in our view.

Moreover, its MDF and plywood units are expected to come on stream from mid-FY19E. With its new MDF plant, Greenply will own almost ~45 percent of India’s MDF capacity and with increasing adoption of MDF in India, Greenply is poised to grow well in the medium term.

IDFC Sec thus expects Greenply’s earnings to double over FY17-20E with most of it being back-ended (FY18 to be a challenging year given GST implementation and ply wood capacity peaking out). We estimate over 25 percent growth in FY20E/21E.

MORE WILL UPDATE SOON!!